Market Meltdown

Six converging catalysts drove the worst session of 2026. The S&P 500 has gone negative for the year. Amazon's after-hours bomb will dominate tomorrow's open.

The AI Inflection Point

From Brute-Force Scaling to Software Optimization: A Market Analysis of AI's Consolidation Phase

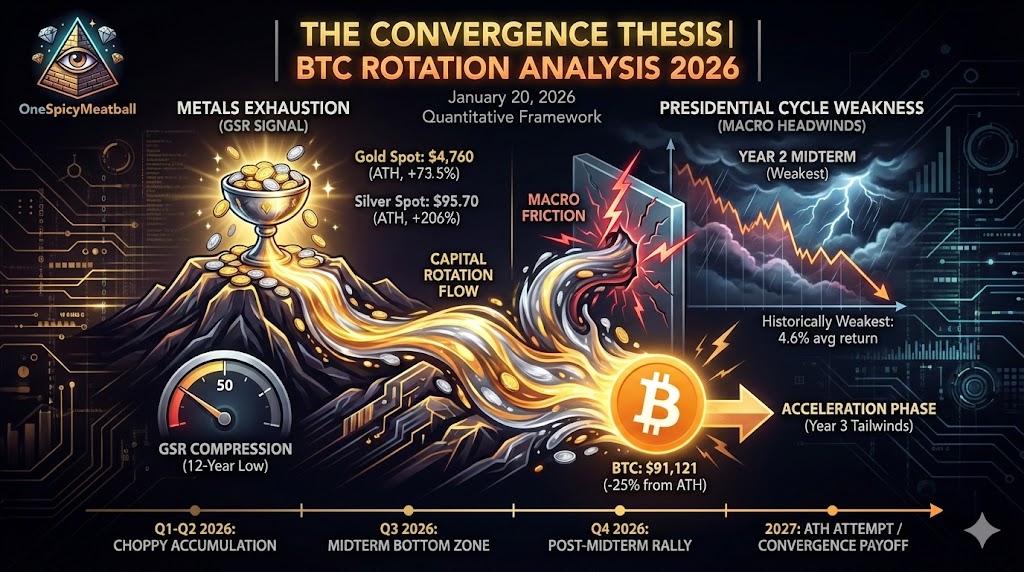

The Convergence Thesis - A look a GSR and the Presidental cycles

When Metals Exhaustion Meets Presidential Cycle Weakness — A Framework for BTC Rotation Timing

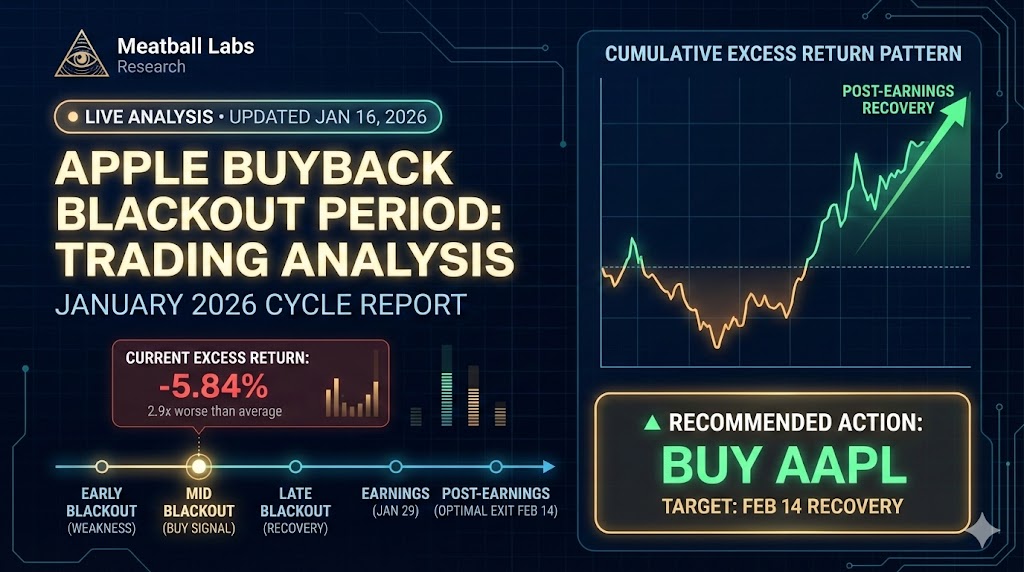

Apple Buyback Blackout Period Trading Analysis

14 years of data reveals a time-dependent pattern in AAPL's largest-in-history buyback program. The weakness is front-loaded—and the trade has flipped.

The Metals-to-Bitcoin Rotation | Capital Flow Research

Research report on capital rotation patterns between gold, silver, and Bitcoin. Understanding the flow sequence for hard money assets

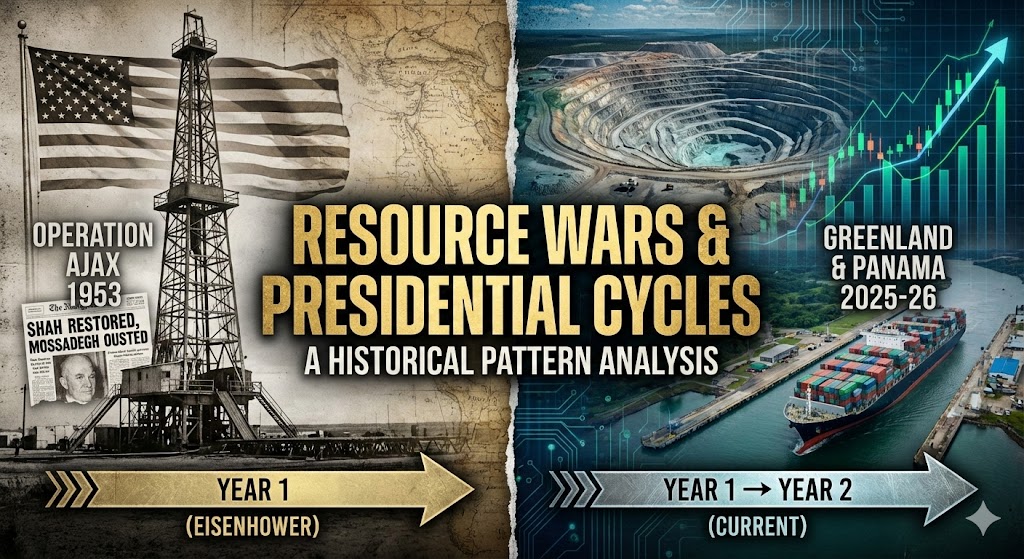

Resource Wars & Presidential Cycles

Drawing parallels between Operation Ajax (1953) and current U.S. geopolitical positioning—through the lens of market cycles.

Multi-Agent Orchestration for Algorithmic Trading

A critical analysis of LLM-based trading systems: where cutting-edge research meets production reality, framework comparisons, and practical implementation guidance for quantitative traders.

Intel's contrarian case: Value GPUs meet existential turnaround

Intel's Value GPU Opportunity Meets Existential Turnaround

Energy Sector Opportunities: AI-Driven Power Demand Creates $720B Investment Runway

Data centers projected to consume 11.7% of U.S. power by 2030. The highest-edge opportunities lie in overlooked infrastructure—midstream pipelines, grid equipment, and utility contractors—where record backlogs haven't been fully priced.

Tesla 3-year investment plan

Covers optimal entry timing aligned with presidential cycle analysis, current market positioning

Hanukkah Week 2025

Fact-checked market analysis for December 15–19

Triple Witching Quarterly - Trading Reference Guide

The quarterly derivatives expiration event that moves trillions. Statistical edges, timing windows, and actionable strategies.

The H4-200MA Trend Protocol

Filtering noise and identifying high-probability trade cycles by aligning Daily bias with the 4-Hour 200 Moving Average.

The Rate Cut Paradox

Front-End Easing, Long-End Repricing

Robotics Investment Command Center

Physical AI is the next wave. Track the thesis, monitor positions, and stay ahead of the humanoid robotics revolution.

Trading FOMC Events: December 2025 Edition

Research around FOMC trading.

December Equity Buyback Blackouts

Market Myths Meet Mixed Evidence: A Comprehensive Analysis

Solana Breakpoint Analysis

Research and analysis on Solana's price action surrounding its annual "Breakpoint" conferences (2021–2024)

The $4 Trillion Optimization

The American healthcare system isn't just expensive; it's economically inefficient. By transitioning to value-based care and leveraging AI to eliminate administrative bloat, we can unlock billions in value—making the system cheaper AND better.

Alphabet Inc. Analysis Report

A comprehensive, multi-tabbed interactive financial report for Alphabet Inc.

Is This "Peak FUD"?

MicroStrategy trades at a discount to its Bitcoin stack. Contrarian data suggests extreme fear may be signaling a bottom.

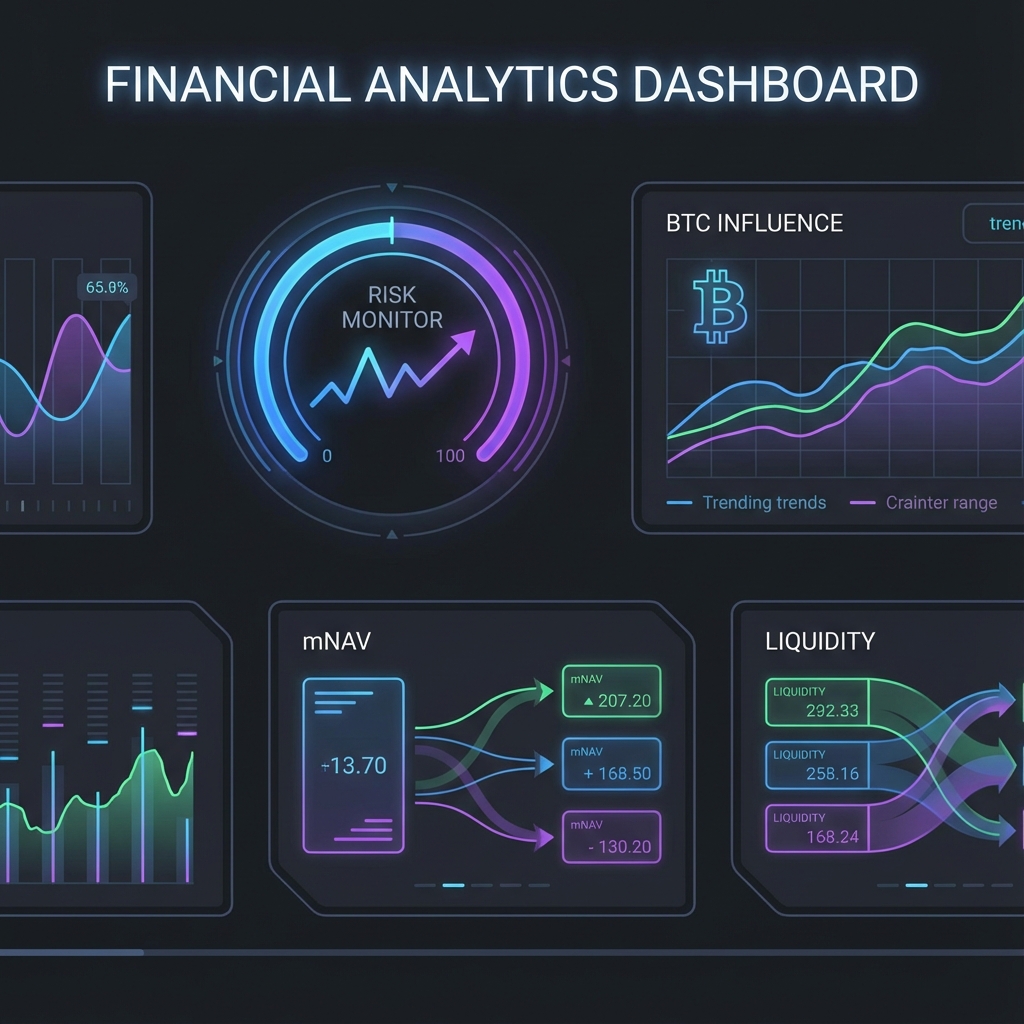

Strategy (MSTR) Risk Monitor

Analysis of mNAV & Liquidity Risks

The Presidential Market Cycle

History suggests the stock market follows a predictable rhythm aligned with the 4-year US presidential term. From the "Midterm Bottom" to the pre-election surge, understanding these patterns is crucial for contextualizing market volatility.

$MSTR ANALYSIS

MicroStrategy ($MSTR) sits at a pivotal historical juncture. Often acting as a high-beta proxy for Bitcoin, the stock has corrected significantly, approaching the 50-month Exponential Moving Average (EMA). In traditional technical analysis, this long-term trendline often separates secular bull markets from deep bear cycles.

TSLA Investment Thesis

Tesla sits at a pivotal intersection. While automotive margins compress due to aggressive pricing and competition, the valuation remains pegged to a future dominated by autonomy (FSD), robotics (Optimus), and energy storage. This dashboard dissects the fundamentals and technicals to form a cohesive thesis.

The Burry Protocol

Actionable intelligence derived from Michael Burry's Year-End Value Strategy.

The Invisible Hands of Year-End

As the fiscal year concludes, two powerful, non-fundamental forces distort stock prices: Window Dressing and Tax-Loss Harvesting. Institutional managers polish their portfolios to impress stakeholders, while retail and professional investors alike sell losing positions to offset tax liabilities.

USD Trajectory: 18-Month Outlook & Market Impact

An 18-month strategic outlook on the US Dollar (DXY), analyzing the collision of Federal Reserve easing, political volatility, and geopolitical realignment.